Bond Valuation Slideshare

The rate of return an investor must earn on an investment to be fully compensated for its risk For bonds the risk. Bond valuation The application of the present value concept Fin351.

Bond Valuation Financial Management

Bond valuation is a technique for determining the theoretical fair value of a particular bond.

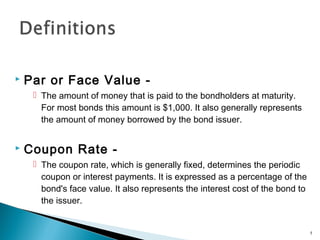

. Structure Introduction Bond valuation Valuation model Bond return Price-yield relationship Bond market The term structure of interest rate yield curve Riding the yield curve Duration. 3883 3770 3661 92403 103717. A bonds face value or par value is the amount an issuer pays to the bondholder once a bond matures.

Chapter 15 Bond Valuation Author. Lay your hands on our Bond Valuation PPT template to describe the process of determining the theoretical fair value of a bond using the present value of its future cash flows. 10222005 101349 PM Document presentation format.

The bonds price is determined as follows. How Bond Valuation Works. The market price of a bond which equals.

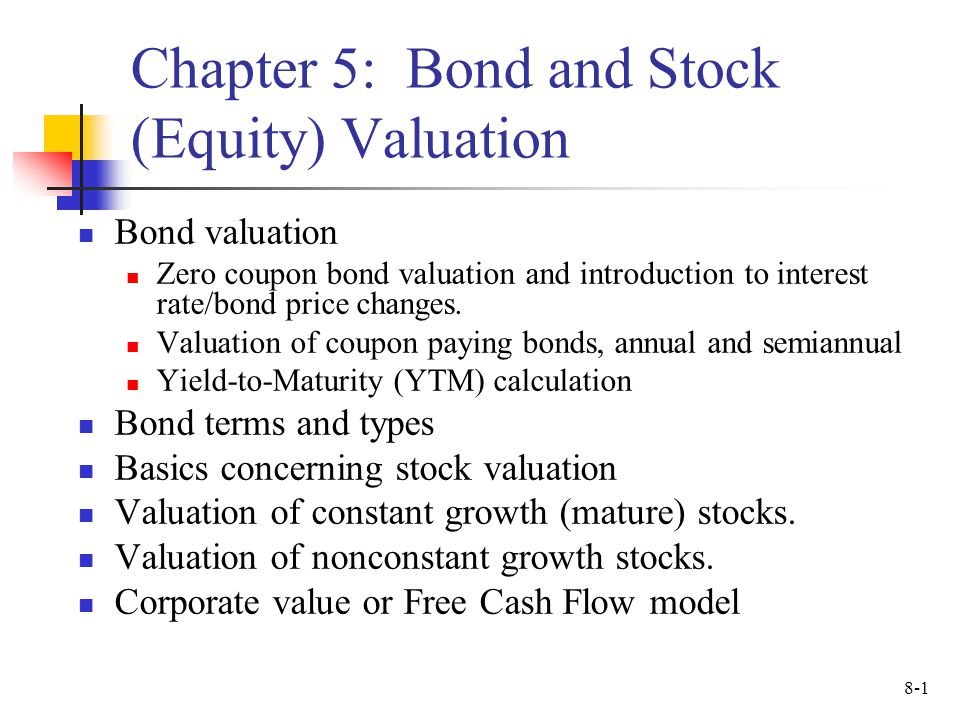

Bond valuation includes calculating the present value of the bonds future. Chapter 11 Bond Valuation. The Issuance of Bonds at a Discount.

Viswanath For a First course in Finance. The method for valuation of bonds involves three steps as follows. To look at the difference between economics.

Bond Valuation method. Todays plan Interest rates and compounding Some terminology about bonds Value. As an alternative to this pricing formula a bond may be priced by treating the coupons as an annuity.

ABC Last modified by. Introduction to Valuation Bond Valuation. Estimate the expected cash flows.

Example 2 On January 1 Muller Inc issues 700 6 20-year bonds with a face value of 1000 at 96 with interest to be paid. Measuring Return Required Return.

Chapter 6 Bond Valuation Ppt Download

Chapter 5 Bond And Stock Equity Valuation Ppt Video Online Download

0 Response to "Bond Valuation Slideshare"

Post a Comment